THIS IS an UPDATE OF a post that originally published on January 15, 2024.

Seems like everybody’s got a price

I wonder how they sleep at night

When the sale comes first and the truth comes second…

From “Price Tag,” written by Lukasz Gottwald, Claude Kelly, Jessica Cornish, & Bobby Ray Simmons Jr. © Warner-Tamerlane Publishing Corp., Studio Beast Music, Ham Squad Music, Songs Of Universal Inc., Songs Of Influence.

The 2024 U.S. Presidential election is almost upon us, capping off an election season packed with worries about eroding democratic norms in the United States (elsewhere too). Some observers say the institution of democracy is close to total collapse.

You might think that Americans would find this alarming. I mean, the world’s inventors and primary defenders of democracy must value it, right? But as I’ll explain, it’s more accurate to say “they put a value on it” — in a way that might imperil democracy’s very survival.

Voters certainly give us pause when they vote for politicians who openly detest democratic institutions (for instance, Bolsonaro in Brazil, Le Pen in France, and Trump in the U.S.). If voters install people like this into office, how much can they really value democracy?

An interesting article by Adserà and colleagues (“Estimating the value of democracy relative to other institutional and economic outcomes among citizens in Brazil, France, and the United States“) provides an answer, and soon I’ll share its key finding. But to help the study make sense requires a brief dive into behavioral economics (BE), which inspired the study’s methods.

• Note: For a nontechnical BE tutorial see here, and for a more sophisticated discussion of premises see here.

Demand and Behavioral Price

A core idea of BE is that reinforcers don’t exist in an either-or fashion. You can’t simply say that, for a given individual, M&Ms are a reinforcer but Skittles are not. Rather, many tangible goods and activities (“commodities,” in BE lingo) can be reinforcers, depending on their price (meaning the amount of behavioral investment on which they are contingent) and other factors. When the price is low, many commodities are reinforcers. When the price is too high, a given commodity ceases to function as a reinforcer.

• Note: You probably already understand this principle at an intuitive level. For instance, there may be crappy movies on Netflix that you’ll happily watch when all that’s required is to press the remote from your sofa; you would never drive to the theater and pay a hefty additional fee to watch them. This is the same thinking underpinning the familiar progressive ratio reinforcement schedule, in which the response requirement rises systematically until a “break point” is achieved in which behavior ceases. In progressive ratio schedules the break point is the behavioral price at which a commodity stops being a reinforcer. You might say it’s the price at which a commodity is no longer valued, i.e., no longer “worth it” in the context of the behavior-consequence contingency.

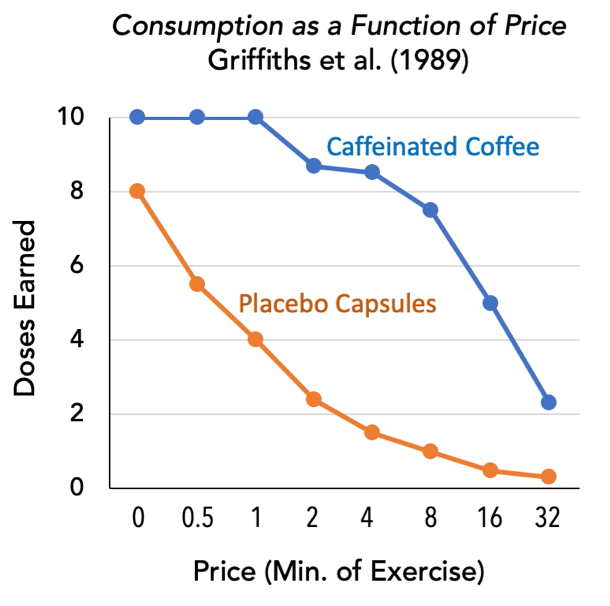

In BE methods, demand means how much of some commodity is “purchased” (earned) at a given behavioral price. Here’s a simple example from a study by Roland Griffiths and colleagues that sought to understand the reinforcing value of caffeine (doesn’t sound like the most compelling research question, I know, but see Postscript 1).

Adult men lived in a residential laboratory where they could work for up to 10 “doses” a day by riding an exercise bicycle for a specified amount of time. On different days a “dose” was either a cup of coffee (caffeinated or not, unlabeled) or a capsule (containing caffeine or a placebo, unlabeled). The price of a dose varied across days from 0 minutes of riding (the men just had to ask for a dose) up to 32 minutes of riding.

To simplify, I’ve shown just the results from the most and least effective reinforcers. In general, demand dropped as price increased. Note that even the (presumably) least attractive commodity, placebo capsules (in orange), functioned as a reinforcer when the price was low, although demand dropped off quickly as price rose. Caffeinated coffee (blue) was considerably more resistant to this effect, showing it to be a more robust reinforcer. The take-home notion to derive for present purposes: The more resistant a commodity is to price increases, the stronger a reinforcer it is (i.e., the more it is “valued”).

Hypothetical Purchase Tasks

As an important aside, I hope you can see how difficult it was to run the Griffiths caffeine study. The participants had to be housed and fed for more than 6 weeks and were compensated financially for their time. The lab had to be staffed 24 hours a day. Needless to say, most labs simply could not mount a study like this, and if they had to, not much human BE research would get done. Another consideration: Sometimes BE research targets outcomes that for various reasons would be impractical to deliver (e.g., imagine a participant purchasing 20 alcoholic beverages to be consumed in one sitting; that a recipe for an Emergency Room visit).

To get around problems like these, BE researchers create hypothetical purchase tasks, in which price-consumption relationships are examined in what-if scenarios. As a way of standardizing across investigations, price is usually operationalized in terms of money. So, instead of riding a bike for a dose of drug, a participant might be asked how many doses they would purchase (and consume) at various prices. In hypothetical purchase tasks, then, verbal reports are taken as measures of consumption, and verbal reports of money expenditures stand in for direct measures of behavioral effort. This allows a variety of commodities and prices to be examined quickly and safely.

• Note: If you’re a behavior analyst who’s been told to be appalled at verbal report measurement and hypothetical scenarios, take heart. These procedures have been extensively vetted and their results correspond closely to demand for various “real” commodities (though see Postscript 2 for a note about a limitation of these procedures).

Value Depends on the Alternatives

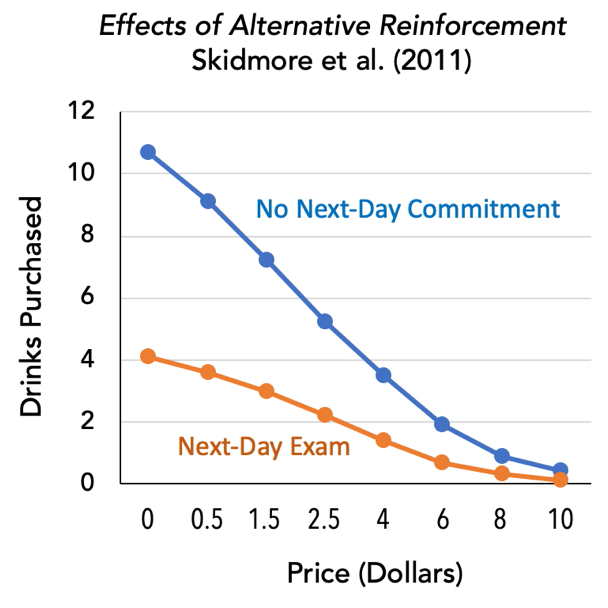

One more detail. This graph shows the result of a hypothetical purchase task experiment that illustrates a second BE principle: Reinforcing value depends on reinforcing alternatives. Skidmore and colleagues (2011) asked college students how many alcoholic beverages they would purchase at an evening gathering given various price points ranging from $0 (free) to $20 per drink.

In one condition, participants were told to imagine that they had an exam scheduled the next day. In another condition, no mention was made of next-day contingencies. In both cases demand dropped as price rose, but demand was systematically depressed in the “test” condition. One way to think about this result: Alcohol is a reinforcer, but its value decreases when consuming it means forfeiting other reinforcers (e.g., if you drink rather than study and show up to a test hungover, your grade is going to suffer).

Democracy in a “Hypothetical Vending Task”

Now you know almost enough to examine the Adserà study, which treated the free elections of democracy as an economic commodity and sought to quantify their value.

There is, however, a key difference between democracy, so defined, and many commodities for which hypothetical purchase tasks are used to determine value: People in the three countries of interest (Brazil, France, and the U.S.) already have free elections, and thus have no need to “purchase” them. So instead of asking what people would purchase at a certain price, in the Adserà study residents of the three countries were asked what it would take for them to give up free elections. Specifically, they considered choices between keeping free elections and giving them up while receiving various monetary benefits.

So, at what price were these people be willing to give up free elections?

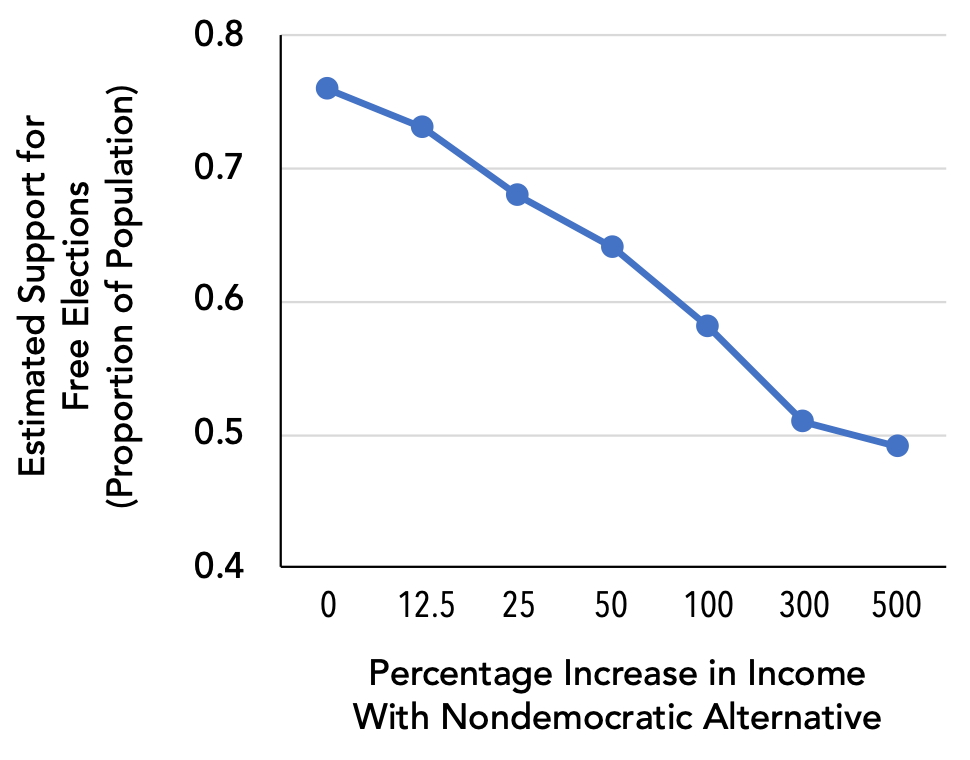

The graph shows the proportion of respondents who said they would prefer democracy over a given-sized increase in income in a nondemocratic alternative. When there was no secondary gain associated with the nondemocratic alternative, most residents preferred free elections. But as the financial windfall accompanying the nondemocratic alternative increased, supporters of free elections became increasingly scarce. When the windfall big enough, support for democracy became a minority proposition.

There’s a tendency in everyday discourse to discuss political beliefs as characterological. Hence in the U.S. we call people conservatives and liberals, as if these are fixed attitudinal categories.We also talk about ourselves, and others who have democracy, as people who cherish it, implying that people in nondemocratic systems — especially in places like Venezuela where democracy has seen better days — must not love democracy enough to fight for it. The Adserà study makes clear that these are oversimplified ideas. What’s both illuminating and terrifying about the results is that they depict support for democracy as transactional. “Democratic” voters do generally like democracy, but they have a price, and they admit that they would abandon democracy for the right “compensation.”

Gorking Out on Tyranny

This makes the occasional free election of tyrannical politicians entirely expected, assuming they can offer up the right “compensation.” Politicians like Bolsonaro, Le Pen, and Trump do make economic promises (what politician doesn’t?), but the “compensation” they offer is not only financial. In the U.S., for instance, Trump promised to all but end immigration and to eliminate the boundaries of church (Christian church, anyway) and state. To some voters, those outcomes might be more attractive than money.

Another gambit commonly employed by tyrannical politicians is to nurture a cult of personality. According to the tyrant’s own story, in a world of weak and sleazy politicians who kowtow to insidious forces and propagate political inertia, only they have the fortitude to stand up and take independent action. Never mind if “taking action” means disregarding democratic institutions! In the U.S., Trump apparently benefitted substantially in 2020 from voters’ frustration with the established political parties, with Congress, and with entrenched special interests. In cases like this, the “compensation” for voter support may simply be seeing an elected official who talks differently than the toadies who came before. Perhaps Trump voters were thinking, “Watching regular politicians try to negotiate our messy democratic system has been a shit show. Let’s get a man who talks action instead.”

If you want a colorful sense of how this dynamic works, I recommend a satirical article in McSweeneys entitled, “Inflation is high, so I’m voting for Gork the merciless.” From the article:

Gork has promised to slaughter our families, sell our children, burn our houses, steal our land, and enslave our people for generations, but milk prices went up, and even though they’re starting to come down, we might as well see whether Gork’s warlord approach is better for the economy.

Political support for a Gork makes zero sense if you think of beliefs like “support for democracy” as fixed mediators of actions like voting. But when free elections and other democratic institutions are viewed through the lens of behavioral economics, they are commodities whose value depends on the context.

The strong implication: You can’t simply depend on citizens’ “democratic ideals” to maintain free elections. Everybody, apparently, has a price at which they’d be willing to sell out democracy. With tyrannical politicians continuing to attract support in many putatively democratic nations, the challenge for supporters of democracy is make sure that such a price is never met. How to accomplish this remains uncertain, but a good start is to think of the institutions of democracy as commodities in a behavioral economic framework, in which value varies as a function of known factors. If there’s an election coming up near you, and you care about democracy, better study up on your behavioral economics.

“Everybody’s Got a Price”

As of this writing, news outlets are reporting that U.S. Democratic Presidential Candidate Kamala Harris has chosen to focus her last couple of weeks of campaigning on persuading voters that Republican opponent Donald Trump is a tyrant. According to this pitch, voters should fear — and definitely not support — Trump because he’s a threat to democracy. But according to the analysis in the Adserà article, that approach will fail if enough people view Trump as offering enough other benefits. When protecting democracy is just one of many simultaneously available reinforcers, that will guiding voting behavior only insofar as protecting democracy is the most valued outcome. And we’ve seen that, while people in democratic nations generally are for democracy, they also have a price that tyrants are happy to offer to meet.

Postscript 1: Reason for Hope?

If you’re inclined to think the BE data provide an unrealistically grim picture, consider a recent survey suggesting that voters still value democratic practices — rather, it’s politicians who’ve gone off the democratic rails. To buy this, however, you have to discount two realities: (1) voters elect those anti-democratic politicians, and (2) BE methods have a solid empirical track record (see Postscript 2), whereas polls are notoriously unreliable (e.g., check out fivehthirtyeight.com’s poll-driven projection giving Hillary Clinton a 71% chance of defeating Donald Trump in the 2016 Presidential election).

Postscript 2: What Hypothetical Tasks Can and Can’t Tell Us

Here’s an important procedural note about hypothetical tasks: They work to the extent that participants have relevant behavioral experience. For example, ask me if I would buy milk at $6 per gallon, or whether I would go for a run if the temperature dropped to -10 F, and I can tell you, because I have been buying milk and exercising outdoors and spending money my whole adult life. But ask me if I would fight back against a mugger or give up one of the Titanic’s few lifeboats to helpless women and children, and I might give you an answer, but in truth I have no idea how I would respond because I’ve never been mugged or found myself on a sinking ship.

Our verbal projections of future behavior, therefore, are grounded in self-observations of past behavior. In the “democracy” study, people’s projections of what they would accept in order to give up free elections are plausible because (a) they have lots experience with money and (b) they live in nations with free elections. Change either of those conditions and the estimates become less plausible.

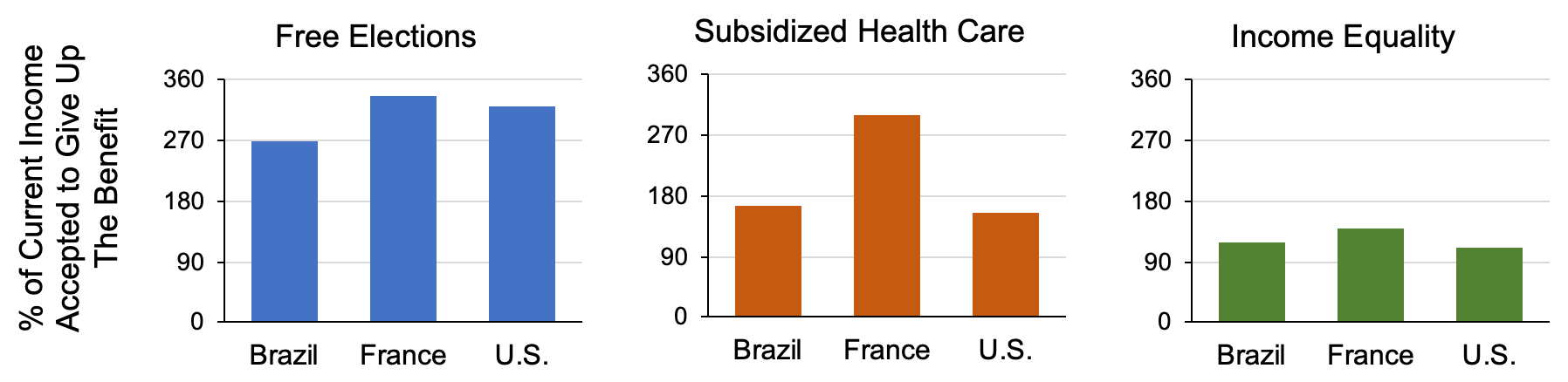

By the way, the Adserà study provides possible examples in which verbal projections may not be fully reliable. In the graph below, the left panel shows the average level of income (% of current income) at which at least half of respondents from three countries said they’d be willing to part with free elections. Their price: roughly triple current income. In addition to free elections, the researchers asked about the amount of extra income people would require to forego certain other aspects of a free society, including subsidized health care and income equality.

The middle panel seems to show that French residents value public health care more than their Brazilian and U.S. counterparts, and indeed the France-Brazil comparison has some credibility, because both nations offer free, publicly-funded health care. But the U.S. does not offer free health care to most residents, so it’s unclear whether U.S. respondents really understand what they’re being asked to give up.

Similarly, the right panel suggests that residents of all three countries place relatively little value on income equality (they’d give that up for a low price). But none of these countries has ever had real income equality. The gini coefficient is a measure of income inequality based on the distribution of incomes in a society. It ranges from 0 (no income disparity) to 1 (extreme disparity). Current gini estimates are

- France = 0.32 (35th best among 163 nations), a score that’s considered “adequate” but not ideal

- U.S. = 0.41 (110th), a score that’s considered to represent “big income inequality“

- Brazil = 0.53 (154th), a score that’s considered to represent “severe income inequality“

We also don’t know how the individual respondents of the Adserà study fell within a nation’s income distribution. It’s simply not clear how all of this might affect the way residents value income equality, highlighting that in examining the results from hypothetical procedures you have to cast a critical eye on what is being measured and how it corresponds to participant life experiences.